The Reserve Bank of India has increased the Repo Rate today by 50 Basis Points on 5th Aug, 2022 (Friday). As RBI hikes repo rate, this could only mean one thing for loan holders: costlier loan along with higher EMI. Read this complete article on Money Niyantran to know all about it and follow us for the latest finance news.

Latest updates on ‘RBI hikes repo rate’:

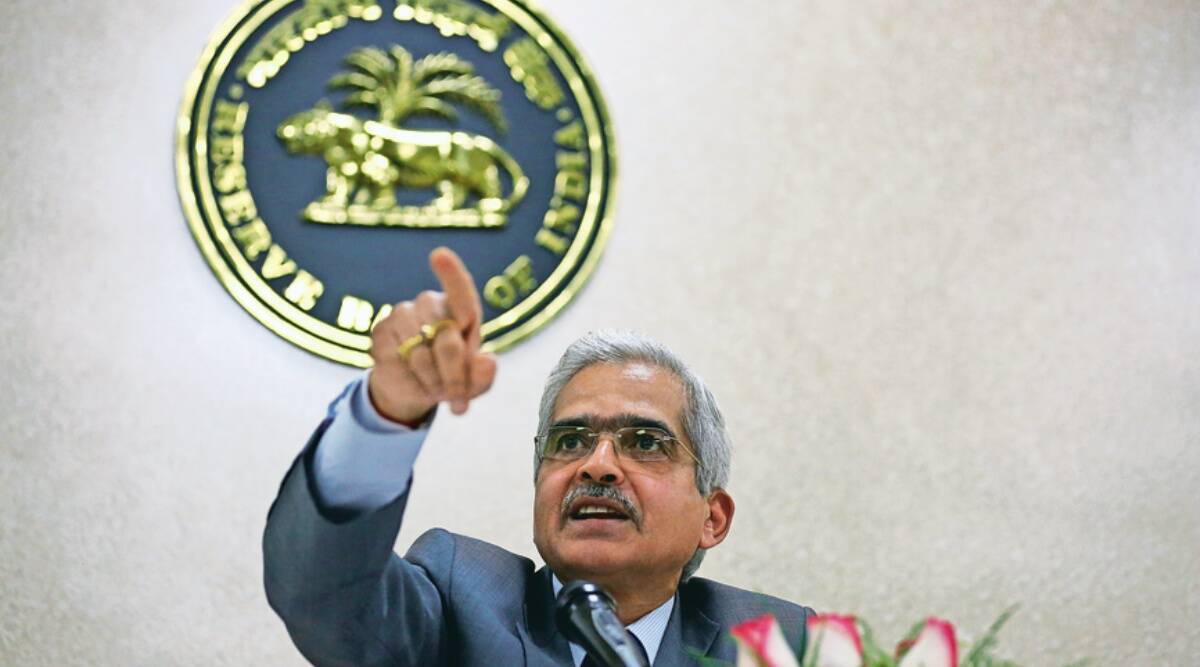

After a series of meetings for three consecutive days, the Monetary Policy Committee (MPC), headed by the Governor of RBI, has arrived at several decisions to reduce the existing inflammatory pressure. The Reserve Bank of India has declared a hike in policy repo rate by 50 basis points, thus reaching to 5.40 percent – the highest since the August of 2019. RBI hikes repo rate in an attempt to tame inflation, as was explained by the Governor of MPC.

While announcing the increase in repo rate, Shaktikanta Das, the Governor of RBI, made the following statement: “Inflation has steeply increased much beyond the upper tolerance level. A large part of the rise in inflation is primarily attributed to a series of supply shocks linked to the war [in Ukraine]. In these circumstances, we have started a gradual and orderly withdrawal of extraordinary accommodation instituted during the pandemic.”

RBI hikes repo rate: how will it affect loan holders?

After the monetary policy meeting conducted on 5th Aug, 2022, RBI hikes repo rate by 50 basis points. What exactly does it mean and how is it going to affect our lives?

- All personal, home and auto loans will become more expensive as soon as there is another increase in the repo rate by RBI to check elevated inflation.

- As RBI hikes repo rate, this will have direct impacts on the loan holders as Non-Banking Financial Companies (NBFCs) and banks will raise the lending rates.

- Loan borrowers will now have to pay higher loan EMIs as housing finance companies and banks will increase their lending rates in response to the hike in repo rate by RBI.

Read More on Money Niyantran:

- Good Luck Jerry Review: Are you ready for a thrilling, rollercoaster ride?

- Mamata Banerjee removes arrested WB Minister Partha Chatterjee from Cabinet

- Amitabh Bachchan and Rashmika Mandanna’s GoodBye will release on Oct 7, 2022

- Marvel Phase 5 movies: The Multiverse Saga complete list, 16 new titles announced

- House of the Dragon Trailer: HBO returns with another epic tale on war over the Iron Throne